AML

At DigiLeap, we help you take a leap above and beyond Digital – way past the visual user experience and implement smart, intelligent, automated, real-time processes in the complex areas of Anti Money Laundering / Countering Financial Terrorism, Know Your Customer and Customer Due Diligence.

Digileap Technologies Services and Solutions

-

Anti Money Laundering Full Cycle Services

-

Customer Due Diligence (CDD)

-

Know Your Customer (KYC)

-

Ultimate Beneficiary Ownership

-

Identity Verification

-

Robotic Process Automation

-

Data Governance Services

AML/CFT and Transaction Monitoring

Strategy

Automation

Technology

Process

Products

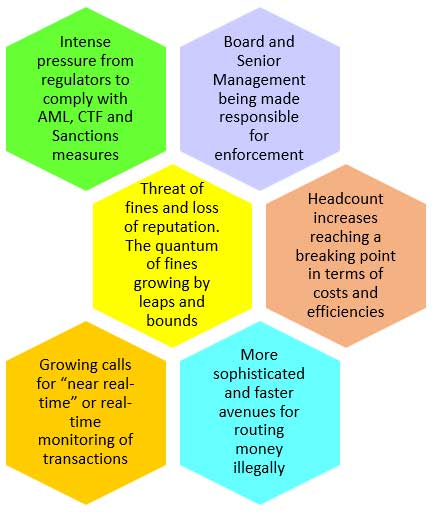

Key Challenges for Banks

Banks face major operational challenges in trying to implement AML,CFL and Sanctions measures as:

- Client Onboarding(COB) and AML processes are largely manual and fragmented between lines-of-business(LOBs), products and geographies.

- New and updated regulations force constant process changes

- KYC information quality is patchy and data ownership is not established

Major Drivers for Implementing AML

There is no single “one-size-fits-all”solution for implementing AML measures for a financial institution.

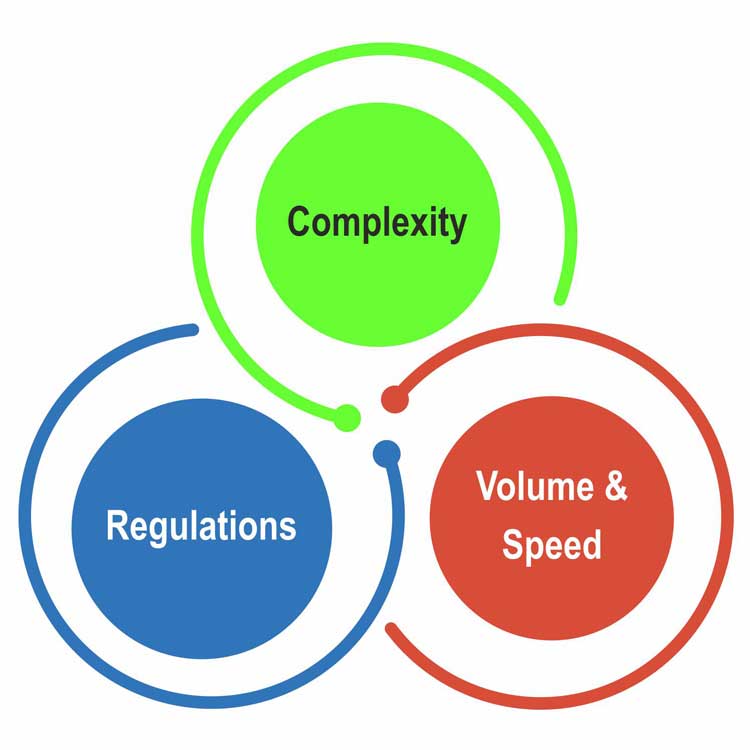

Complexity

The products and channels used by the customers, the geographies operated by the bank. Centralizing the customer information helps in analysing customer behaviour across multiple countries, accounts business verticals, channels and products

Regulations

The regulations in force currently and those likely to be implemented in future.In this regards,it is expected that regulators will get tougher on the industry despite rise in compliance costs.

Volume and speed

The level of AML automation required. This is determined by the volume of transactions and expected speed of transactions. There are limitations in throwing bodies at the ever-increasing requirements for monitoring and reporting; automation is required after a point

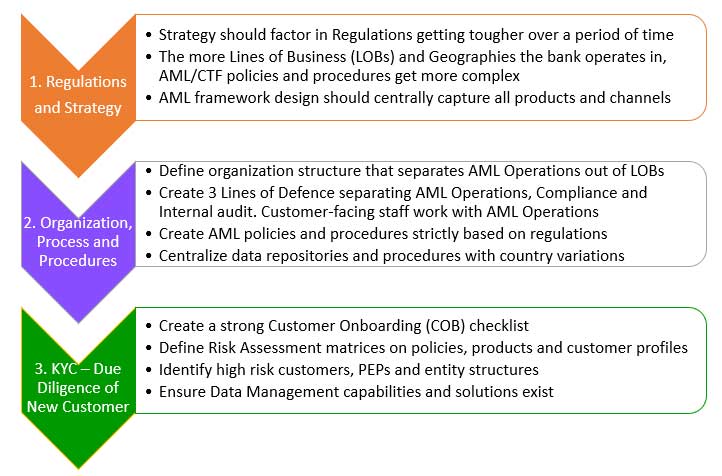

AML Program Lifecycle

The program lifecycle is determined through the applicable regulations, organizational business processes and procedures, the applicable onetime KYC processes to lead to the on-boarding of customers

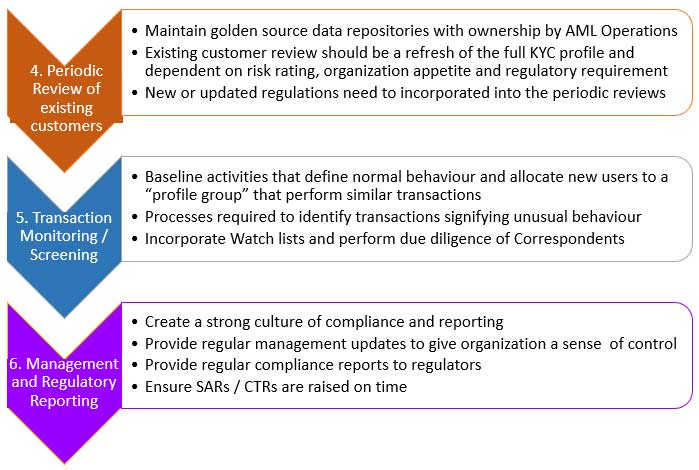

AML Program Lifecycle(Post Onboarding)

The post-onboarding lifecycle involves periodic review of customers and comprehensive transaction monitoring in realtime as well as in batch mode.