Diligent CDD Platform

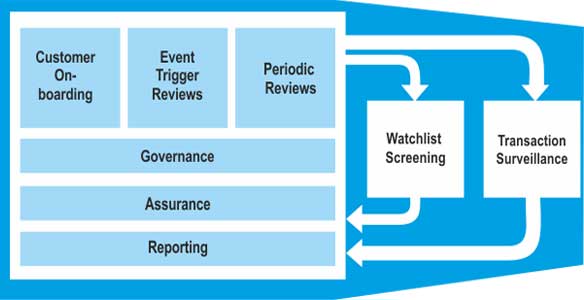

Our Diligent platform offers a “ready-to-implement”, configurable CDD operating model which ensures Regulatory Compliance across client segments

Increasing regulatory pressures for Anti-Money Laundering (AML) compliance have burdened banks with challenging responsibilities. Banks are responsible not just for funds directly handled by their customers, but also by other banks with whom they have correspondent banking relationships. As a bank’s Business or Compliance head, your need is clear – a robust platform that automates Customer Due Diligence (CDD) / Know your customer (KYC) processes and ensures Regulatory Compliance.

Diligent – your gateway to AML compliance

Developed by experienced AML practitioners in global banks, Diligent automates every process needed for KYC/CDD – from on-boarding, to tracking and handling trigger events and periodic reviews. A risk based modular Product structure ensures need based collection of data and documents. The solution is ‘Ready to implement” and highly “configurable”. This ensures quick implementation and ease of operationalising ongoing changes to regulations and policies.

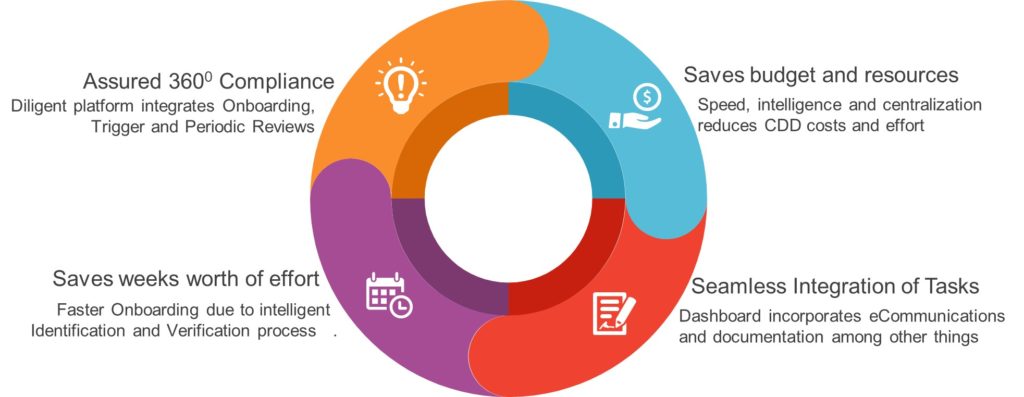

Benefits of Diligent Solutions

With a robust, customizable and reliant solution, your needs require no other. Diligent is here to help you navigate the conundrums of AML-compliance with these benefits:

Save weeks, not days

All your customer relationships can be brought under the AML lens with a few clicks of a button, which dramatically reduces time and effort. Completely do away with duplicated efforts, that are so common today. Electronic tracking and archival of documents simplifies reporting as well as review.

Assure compliance during On-boarding & Ongoing relationship

Most solutions in the market enable you to on-board customers. Diligent enables you to manage CDD processes for Trigger events (due to changes in static data,transaction alerts or name screening results) and Periodic reviews as well.

Achieve more with integration

With a seamlessly integrated solution, you can operate right within the Diligent dashboard to accomplish the required tasks. Even internal email correspondences can easily be tagged to a customer profile, eliminating redundant printing and scanning of documents.

Summary of Benefits across stakeholders

| S.No. | Key Benefit | Board/Senior Mgmt | Front Line | CDD/ KYC Operations |

|---|---|---|---|---|

| 1. | Risk based approach to Regulatory Compliance at ALL times | ✓ | ✓ | |

| 2. | Reduces Onboarding time; Superior Customer experience | ✓ | ✓ | |

| 3. | Enhances RM productivity by 25% to 40% | ✓ | ✓ | |

| 4. | Consistent application of Policy across Geographies | ✓ | ✓ | |

| 5. | Instant operationalisation of Regulatory or Policy change | ✓ | ✓ | |

| 6. | Eliminates need for Policy interpretation | ✓ | ✓ | |

| 7. | Flexibility in operating models – Supports processing hubs | ✓ | ✓ | |

| 8. | Ensures Business is always AUDIT READY | ✓ | ✓ | ✓ |

| 9. | Reduces Key Man risk | ✓ |

Diligent has got you covered

Diligent is here to ensure you deliver the best-in-class service to your clientele, fortified with iron-clad AML compliance. Experience these best-in-class features with our solution:

Get going CapEx-free

With Diligent offered as a cloud-based solution, capital expenditures are a thing of the past. If, however you prefer an On-premise solution, we offer the same as well.

Easy integration

Your IT teams can rest easy too, since Diligent integrates with your existing system seamlessly. Integration with e-channels enables customer self-service for updating documents (obviating the need for manual follow-up).

Meets evolving needs

The Diligent platform closely tracks the regulatory guidelines and continuously evolves in sync with changing policies and procedures.