Digileap AML/KYC Offerings-copy

-

Anti Money Laundering Full Cycle Services

-

Customer Due Diligence (CDD)

-

Know Your Customer (KYC)

-

Ultimate Beneficiary Ownership

-

Identity Verfication

-

Robotic Process Automation

-

Data Governance Services

AML/CFL and Transaction Monitoring

Automation

Products

Process

Technology

Strategy

Key Challenges for Banks

Banks face major operational challenges in trying to implement AML,CFL and Sanctions measures as:

- Client Onboarding(COB) and AML processes are largely manual and fragmented between lines-of-business(LOBs), products and geographies.

- New and updated regulations force constant process changes

- KYC information quality is patchy and data ownership is not established

Intense pressure

from

regulators to

comply with

AML,CTF and

Sanctions

measures

Board and

Senior

Management

being made

responsible

for

enforcement

Threat of

fines and

loss of

reputation.The

quantum of fines

growing by

leaps and bounds

Headcount

increases

reaching a

breaking point

in terms

of costs and

efficiencies

Growing calls

for ” near

real-time”or

real-time

monitoring

of

transactions

More

sophisticated

and faster

avenues for

routing

money

illegally

Major Drivers for Implementing AML

There is no single “one-size-fits-all”solution for implementing AML measures for a financial institution.

Complexity

The products and channels used by the customers,the geographies operated by the bank.Centralizing the customer information helps in analysing customer behaviour across multiple countries, accounts business verticals, channels and products

Regulations

The regulations in force currently and those likely to be implemented in future.In this regards,it is expected that regulators will get tougher on the industry despite rise in compliance costs.

Volume and speed

The level of AML automation required. This is determined by the volume of transactions and expected speed of transactions. There are limitations in throwing bodies at the ever-increasing requirements for monitoring and reporting automation is required after a point

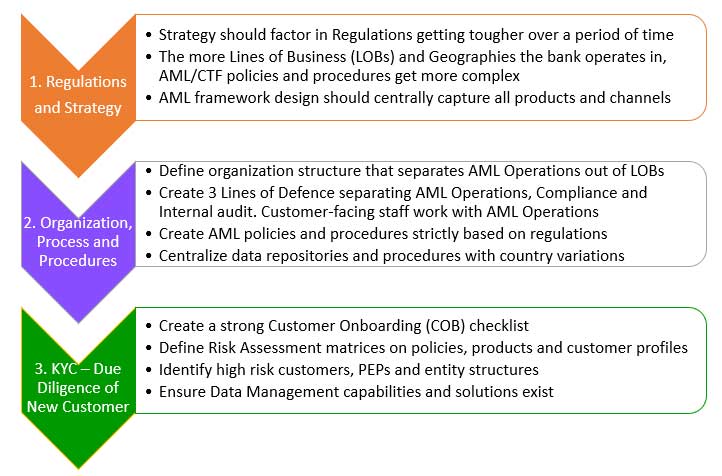

1.Regulations and Strategy

- Strategy should factor in Regulations getting tougher over a period of time

- The more Lines of Business(LOBs)and Geographies the bank operates in,AML/CTF policies and procedures get more complex

- AML framework design should centrally capture all products and channels

2.Organization,Process and Procedures

- Define organization structure that separates AML Operations out of LOBs

- Create 3 Lines of Defence separating AML Operations,Compliance and Internal audit.Customer-facing staff work with AML Operations

- Create AML policies and procedures strictly based on regulations

- Centralize data repositories and procedures with country variations

3.KYC Due Diligence of New Customer

- Create a strong Customer Onboarding(COB) checklist

- Define Risk Assessment matrices on policies,products and customer profiles

- Identify high risk customers,PEPs and entity structures

- Ensure Data Management capabilities and solutions exist

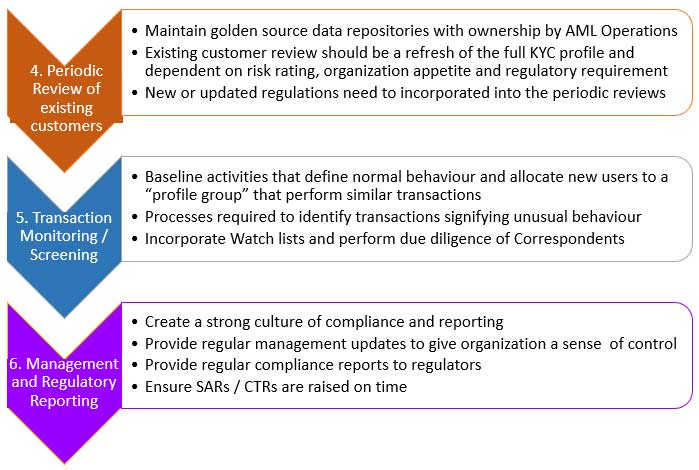

4.Periodic Review of existing customers

- Maintain golden source data repositories with ownership by AML Operations

- Existing customer review should be a refresh of the full KYC profile and dependent on risk rating,organization appetite and regulatory requirement

- New or updated regulations need to incorporated into the periodic reviews

5.Transaction

Monitoring /

Screening

- Baseline activities that define normal behaviour and allocate new users to a “profile group” that perform similar transactions

- Processes required to identify transactions signifying unusual behaviour

- Incorporate Watch lists and perform due diligence of Correspondents

6.Management and

Regulatory

Reporting

- Create a strong culture of compliance and reporting

- Provide regular management updates to give organization a sense of control

- Provide regular compliance reports to regulators

- Ensure SARs / CTRs are raised on time