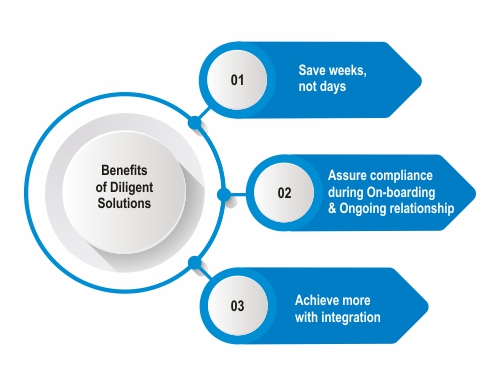

Our Diligent platform offers a “ready-to-implement”, configurable CDD operating model which ensures Regulatory Compliance across client segments

Increasing regulatory pressures for Anti-Money Laundering (AML) compliance have burdened banks with challenging responsibilities. Banks are responsible not just for funds directly handled by their customers, but also by other banks with whom they have correspondent banking relationships. As a bank’s Business or Compliance head, your need is clear – a robust platform that automates Customer Due Diligence (CDD) / Know your customer (KYC) processes and ensures Regulatory Compliance.